Cheques

A cheque is a piece of document/paper which orders the bank to transfer money from the bank account of an individual or an organisation to another bank account.

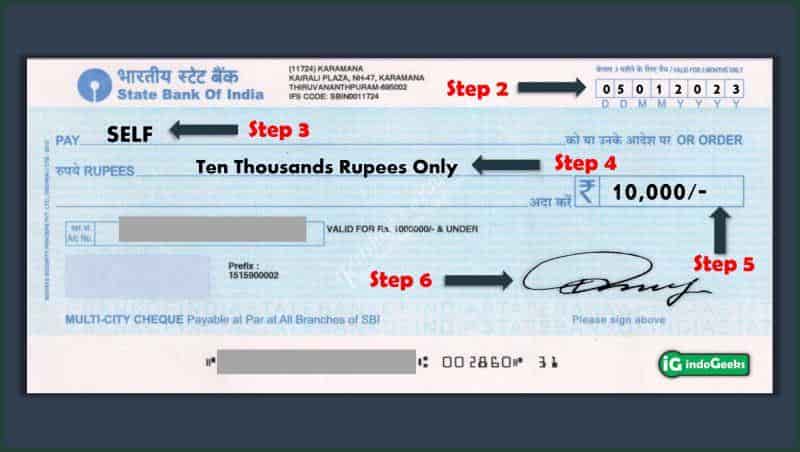

The person who writes the cheque is called the “drawer” and the person in whose name the cheque has been issued is called the “payee”. The amount of money that needs to be transferred, payee’s name, date and signature of the drawer are all mentioned in a cheque.

There are certain points to remember regarding cheques which are mentioned below:

- A cheque can only be issued against a current or savings bank account

- A cheque without date shall be considered invalid

- Only the payee, in whose name the cheque has been issued, can encash it

- A cheque is only valid 3 months from the date it has been issued

- A 9-digit MICR (Magnetic Ink Character Recognition) code is mentioned at the bottom of the cheque. This makes the clearance of cheques easier for the banks.

Further below each type of cheque has been discussed in detail for candidates to study and prepare themselves for the upcoming Government exams.

Essentials of a Cheque

There are certain extremely important pointers or features of a cheque which should be known and understood before using this payment mode for money transfer. Some of the important pointers related to a cheque are:

- A cheque is an unconditional order.

- A cheque’s payment is always in cash.

- A cheque is always drawn on a particular Bank.

- A cheque is always payable on demand.

- Signature on the exchequer is mandatory and should be only by the maker.

- The amount is always a certain sum of money from one’s account.

- This cash amount is to be paid to the person mentioned therein, or order, or the bearer.

Aspirants must know that any direct or indirect question may be asked from this topic in the general awareness section and they must be completely prepared for the same.

Types of Cheques

- Bearer Cheque

- Order Cheque

- Crossed Cheque

- Account Payee Cheque

- Stale Cheque

- Post Dated Cheque

- Ante Dated Cheque

- Self Cheque

- Traveler’s Cheque

- Mutilated Cheque

- Blank Cheque

Bearer Cheque

The bearer cheque is a type of cheque in which the bearer is authorised to get the cheque encashed. This means the person who carries the cheque to the bank has the authority to ask the bank for encashment.

This type of cheque can be used for cash withdrawal. This kind of cheque is endorsable. No kind of identification is required for the bearer of the cheque.

Order Cheque

This type of cheque cannot be endorsed, i.e., only the payee, whose name has been mentioned in the cheque is liable to get cash for that amount. The drawer needs to strike the “OR BEARER” mark as mentioned on the cheque so that the cheque can only be encashed to the payee.

Crossed Cheque

In this type of cheque, no cash withdrawal can be done. The amount can only be transferred from the drawer’s account to the payee’s account. Any third party can visit the bank to submit the cheque.

In case of a crossed cheque, the drawer must draw two lines at the left top corner of the cheque.

Account Payee Cheque

This is the same as the account payee cheque but no third party involvement is required. The amount shall be transferred directly to the payee’s account number.

To ensure that it is an account payee cheque, two lines are made on the left top corner of the cheque, labelling it for “A/C PAYEE”.

Stale Cheque

In India, any cheque is valid only until 3 months from the date of issue. So if a payee moves to the bank to get withdrawal for a cheque which was signed 3 months ago, the cheque shall be declared a stale cheque.

For example: If a cheque is dated January 1, 2021, and the payee visits the bank for withdrawal on May 1, 2021, his/her request shall be denied and the cheque is declared stale.

Post Dated Cheque

If a drawer wants the payee to apply for withdrawal or transfer of money after the present date, then he/she can fill a post dated cheque.

For example: If the date on which the drawer is filling the cheque is May 10, 2021, but he wants the payment to be done later, he/she can fill the cheque dates as May 30, 2021. It shall be called a post-dated cheque.

Ante Dated Cheque

If the drawer mentions a date prior to the current date on the cheque, it is called ante dated cheque.

Self Cheque

If the drawer wishes cash for himself he can issue a cheque where in place of the Payee’s name he can write “SELF” and get encashment from the branch where he owns an account.

Traveller’s Cheque

As the name suggests, the Traveler’s cheque can be used when a person is travelling abroad where the Indian currency is not used.

If a person is travelling abroad, he can carry the traveller’s cheque and get encashment for the same in abroad countries.

Mutilated Cheque

If a cheque reaches the bank in a torn condition, it is called a mutilated cheque. If the cheque is torn into two or more pieces and the relevant information is torn, the bank shall reject the cheque and declare it invalid, until the drawer confirms its validation.

If the cheque is torn from the corners and all the important data on the cheque is intact, then the bank may process the cheque further.

Blank Cheque

When a cheque only has a drawer’s signature and all the other fields are left empty, then such a type of a cheque is called a blank cheque.

According to the Reserve Bank of India, a bearer cheque has a three-month validity period. After three months, the cheque becomes stale, the same as a dead cheque in that it is no longer valid. Therefore, banks will not accept such checks.

Number of Parties involved with a Cheque

There are three parties involved with a cheque.

- Drawer or Maker – Drawer of the cheque is the customer or account holder who issues the cheque.

- Drawee – Drawee is basically the bank on which the cheque is drawn. Remember that a cheque is always drawn on a particular banker.

- Payee – This is the person who is named in the cheque and gets the payment for the amount mentioned in the cheque. In particular cases (when the drawer writes a self-cheque), the drawer and the payee can be the same individual.

Apart from these three, there are two more parties involved with a cheque –

- Endorser: When a party i.e. payee transfers his right to take the payment to another party, he/she is called endorser.

- Endorsee: The party in whose favour, the right is transferred, is called endorsee.

Comments

Post a Comment